Join Our Community of Tax Hackers…

On a journey to building tax-efficient wealth

ABOUT THE TAX-EFFICIENT WEALTH MEMBERSHIP NETWORK

Our Mission Is Transformation

As a community, we want transformation. Transformation individually and collectively as a community. And we will get transformation by learning, growing, and taking action. As you learn new ideas, you take steps to implement them in your life. As you implement these ideas, you will grow in many areas of your life – personal development, career, business, personal finance, spirituality, etc. As you grow, you will share more and help others grow as well. To accomplish this, we all need to stay engaged in the community.

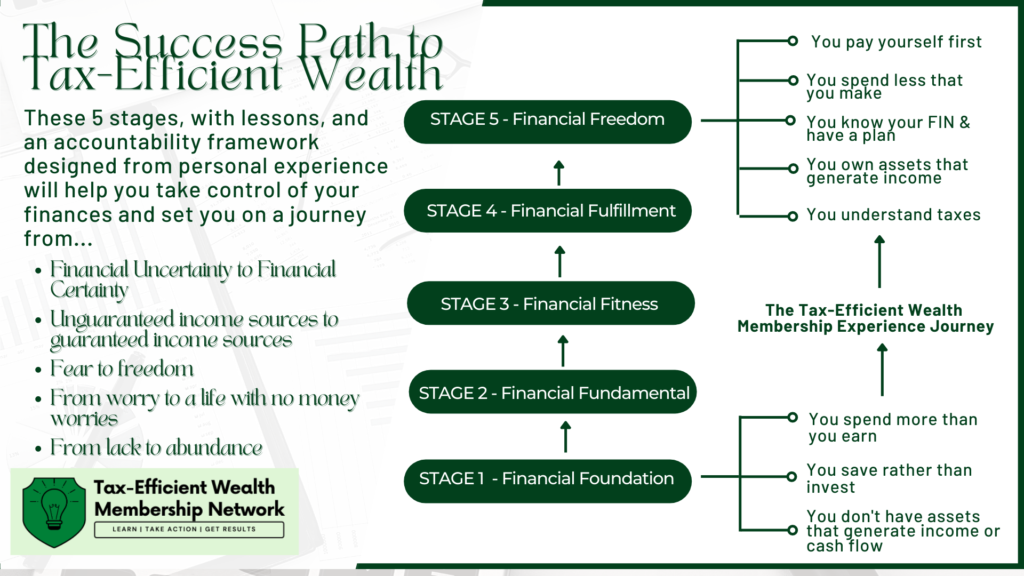

Our Success Path To Tax-Efficient Wealth

With an understanding that every member is at a different stage in their financial journey, we’ve designed a Success Path that will help you identify where you are on this journey as well as tools and resources to help you move along this path to your ultimate goal.

Our Success Path is made up of the following 5 stages:

Inside the community, these stages are clearly defined with milestones and action plans to help you along your journey to financial freedom. As a member, one of the first steps you will take is to the do the new member assessment to identify yourself on this success path and to determine your immediate next steps.

My Role In The Community

I’m simply a host. So, my role, for the most part, is to moderate, create a structure for the community, lead some of the discussions, contribute, and help new members by helping them get the most out of this community. And as the community grows, other members join me in this role.

Your Role In The Community

Your role is to play an active role in learning and contributing to the learning of others in the community. This will require you to be open to new ideas, open to change, exercise patience, and to be generally open-minded. Rather than give advice, you share your stories, experiences, and ideas to motivate other members.

What we do together in the community

What we do in the community will change from time to time as members come up with fresh ideas. However, below are some things we currently have in place to put some structure in the community:

Monthly Themes & Weekly Activities

We have monthly themes to guide our weekly discussions in the community. The weekly activities are simple things like a poll, a blog post, an article, a short LIVE call, etc. all focused on the monthly theme. The idea behind this is to get members taking action on an idea weekly.

Monthly AMA (Ask Me Anything) LIVE calls

Each month, we have a LIVE call to learn, connect with each other, and share our wins and accomplishments over the last month. It’s also an opportunity for me to answer any questions and for all of us to share ideas on how we can improve the community.

Member Profile Story

We love to profile members in our community as this helps to motivate others. For this, I set up time to interview a member and then share the member’s story in an article or video inside the community. Our goal is to feature every member.

Give/Ask Post

Periodically (monthly or weekly), we feature a “Give/Ask” post where we profile a member (short profile compared to the member profile story above) and ask the member to give one thing to other members and ask for one thing from other members.

Courses/Training Content

To help members grow, we have a number of courses and training videos in the community. These training resources are great learning resources to help you on your path to Tax-Efficient Wealth.

ABOUT me

MY STORY

I immigrated to Canada in January 2002 to join my wife, who had arrived in the country four months earlier. I can clearly recall how excited and anxious I was watching my wife board the plane from the International airport in Lagos, Nigeria on her way to Canada to begin her post graduate degree in Saskatoon, a relatively small city in Saskatchewan. At the time, I could not wait to join her.

As I adjusted to a new life in Canada, I had dreams of creating a better future, building a family and creating wealth in our new home. I shared my hopes, dreams, desires and fears daily with my wife and all I wanted was to financially support my wife, who was a full-time student at the time with a part-time job washing dishes at a restaurant.

I struggled finding a job that matched my qualifications. I had a bachelor’s degree in Chemical Engineering with over 4 years of work experience in the Financial Services Industry. At the time, as an immigrant, it was incredibly challenging to find relevant work with no Canadian education or Canadian work experience. It turned out I had little preparation for the challenges I would encounter in my search for a job in Canada.

As our savings quickly vanished with tuition, rent, food and other living expenses, I started feeling the financial pressure. On a daily basis, I wondered what the future would be like. Even worse, I felt terrible and so shameful that I could not contribute financially. Each day, I would watch my wife come home from school, study and work her part-time job at the restaurant to ensure we had some money for food and rent. She worked so hard and was graceful in her support and encouragement as I continued to struggle with my job search. I felt like a failure as I could not support financially and certainly lost my pride as a man as I carried this weight of disappointment on my shoulders.

With the mounting financial pressure, I gave up my search for a job that matched my qualifications and started looking for any hustle that will provide income. I moved from one menial job to another working at minimum wage — stacking papers in a newspaper publishing company, stocking shelves at the grocery stores and working in production lines at various factories. This certainly helped but the income stream was small and inconsistent as it was almost impossible to get any full-time hustle.

As I continued to struggle, it suddenly dawned on me…why did I abandon my dreams? Why did I stop investing in myself and in my education? I recalled various conversations I had with my wife, friends and other family members, conversations on the importance of keeping your eyes focused on the big picture and pushing past challenges. With the encouragement from my wife, I moved to Toronto in 2003 to start an MBA program at the Schulich Business School at York University, all funded with debt.

My wife graduated from her post-graduate program and joined me in Toronto. We still had no jobs, no assets, no income and now a lot of debt. Essentially, our net worth was negative. Later in 2003, my wife got a part-time job with one of the big five banks in Toronto and in 2004, got her first full-time offer with another bank. We were ecstatic, it was a breakthrough for us! Shortly after I finished my MBA program in 2005, I got my first job with one of the big four professional accounting firms in Toronto with a starting salary of $45,000. Although, I had hopes of getting a six figure salary after my MBA program, I was excited to get my first job. Together with my wife, we now had a household income of approximately $75,000, higher than the average Canadian family. With the income, we were able to pay off my student loans, save some money and in the Summer of 2006, bought our home as first-time home buyers.

As our income grew, I noticed we were keeping less and less of it, principally due to high taxes. Although, we had overcome the initial financial challenges we had when we initially arrived in Canada, we were still struggling as we lived from paycheck to paycheck. I figured there had to be a better way. I tried a number of different things and stumbled onto a few real estate investing educational programs. I was sold on the idea of creating wealth through real estate and started investing in several real estate educational programs. My plan was to become a professional real estate investor and eventually leave my regular day job to pursue real estate full-time. Over time, my wife and I acquired several rental real estate properties.

While I have made significant progress in building my net worth and growing my income year over year, I continued to pay a significant amount of the income earned in taxes. So, this got me on the path of learning as much as I could about taxes. In 2010, I started a side hustle providing tax planning and compliance services and in 2012 formed a corporation with two other partners to launch a CPA (Chartered Professional Accountants) firm in the Toronto area.

It has been an incredible journey of learning — learning from our clients, and from the stories of their victories and struggles; learning from the challenges of running my own businesses; learning from my mentors and the various mastermind groups I’m part of; digging deeper into the Canadian tax law to learn more; uncovering the various tools the wealthy use to build and accelerate wealth; getting enormous encouragement from other business owners, particularly, my band of brothers in Christ; and of course, getting a ton of love and encouragement from my brothers and sisters in our broader church community.

Today, along my with my wife and business partners, we control millions of dollars in rental real estate assets and generate over a million dollars in annual gross revenues from our businesses. I have helped hundreds of clients — professionals and business owners — manage their taxes and get clarity on how they run their affairs and businesses. As I continue on this journey of life-long learning, I look forward to helping more and more people build a stronger financial fortress for themselves, their families and businesses. I am grateful for the support and encouragement I continue to get from my wife, Marie and I watch with excitement as I teach my kids — John, Hallie and Adiel — the fundamentals of business, money management and financial accounting.

I hope that my story can encourage you to continue to invest in yourself, to keep working harder and smarter, to keep your dream alive. Part of what I do, is to help you create a plan and put action plans in place to see you accomplish your desires. Together, we are all on a journey to learn, grow and impact our world as we share the insights from our journey.

With love,

Ken Green, CPA, CA, MBA

Lets Talk

Get In Touch

Thank you for your interest in contacting me. I understand you may have questions as you’re considering working with me. I will be more than happy to answer your questions through one of the options below: