TAX EFFICIENT WEALTH SUMMIT LIVE, June 21st - Registration Ends Soon, So Don’t Wait!

Beat Inflation, Slash Your Taxes Legally, and Build Wealth That Lasts

Learn How Canada’s Smartest Investors Protect Their Financial Future At The Tax-Efficient Wealth Summit

Live in Person on June 21st, 2025!

Gain practical, insider strategies for legally reducing your taxes, preserving wealth in an inflationary economy, and building a financial legacy — without being crushed by rising costs or doing it alone.

The Tax-Efficient Wealth Summit is for you if you are serious about tax-efficiency, wealth protection, and accelerated financial freedom.

You will get the expert insights and smart leverage you need to dominate in business and in life.

Event Details

WHEN | Saturday, June 21, 2025

WHERE | Doubletree by Hilton Toronto Airport West Hotel, 5444 Dixie Road, Mississauga, Ontario L4W 2L2

TIME | 10:00 AM to 2:00 PM

COST | $97 TODAY; $117 after midnight on June 8th; $127 after Midnight on Jun 15th

5 REASONS WHY YOU SHOULD ATTEND THIS SUMMIT

Reason # 1: The taxes you pay (income tax, HST, payroll taxes, etc.) is your biggest cost, and tax rates are only set to increase in the near future. You need strategies to combat the impact of high taxes now and in the future.

Reason # 2: We live in an inflationary environment so you have to protect your purchasing power and protect the value of your investments and wealth.

Reason # 3: With increasing prices, how can the next generation afford to buy anything? How can our kids own assets and how can we transfer our wealth in the most tax-efficient manner? Learn how to structure your affairs to minimize taxable events as you plan to transfer knowledge and assets to the next generation.

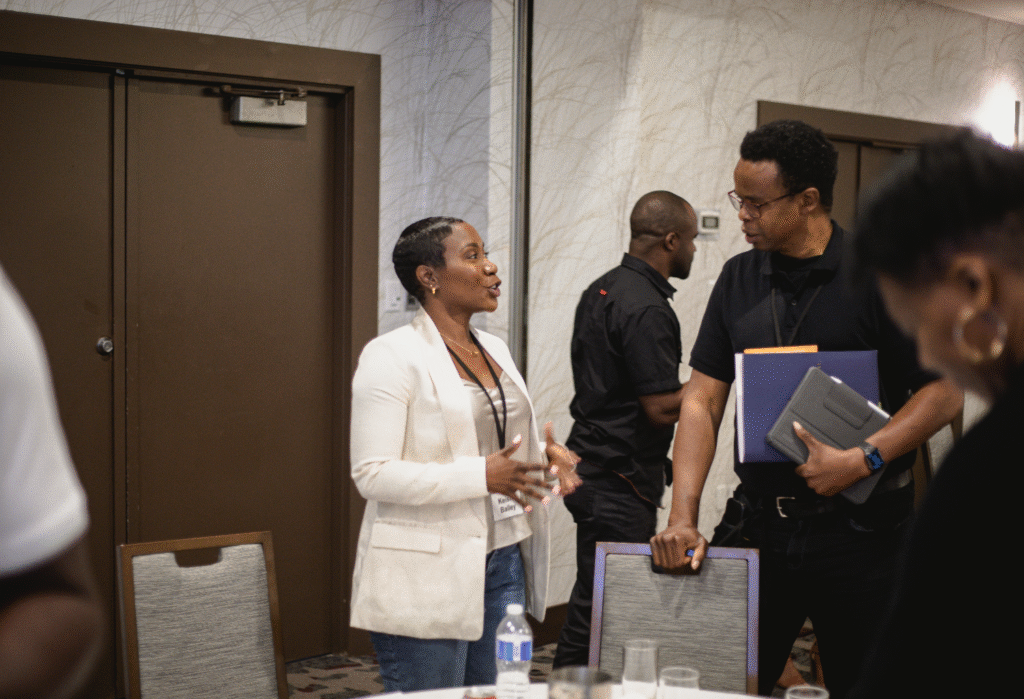

Reason # 4: It is becoming more and more challenging to go on this journey of wealth building on your own. Connect with others like you and learn how to leverage other people’s money, time, and resources to shrink the time required to achieve financial freedom.

Reason # 5: Luckily, the Government offers us tax-free opportunities through what I call the “THE TAX-FREE FINAL FIVE” – (1) Principal residence; (2) Tax-Free Savings Account; (3) Tax-Exempt Life Insurance; (4) First Home Savings Account; and (5) Lottery Winnings. You need to learn how to take advantage of these (Well…I don’t recommend lottery :)) and never have to pay taxes again.

Meet Your Experts

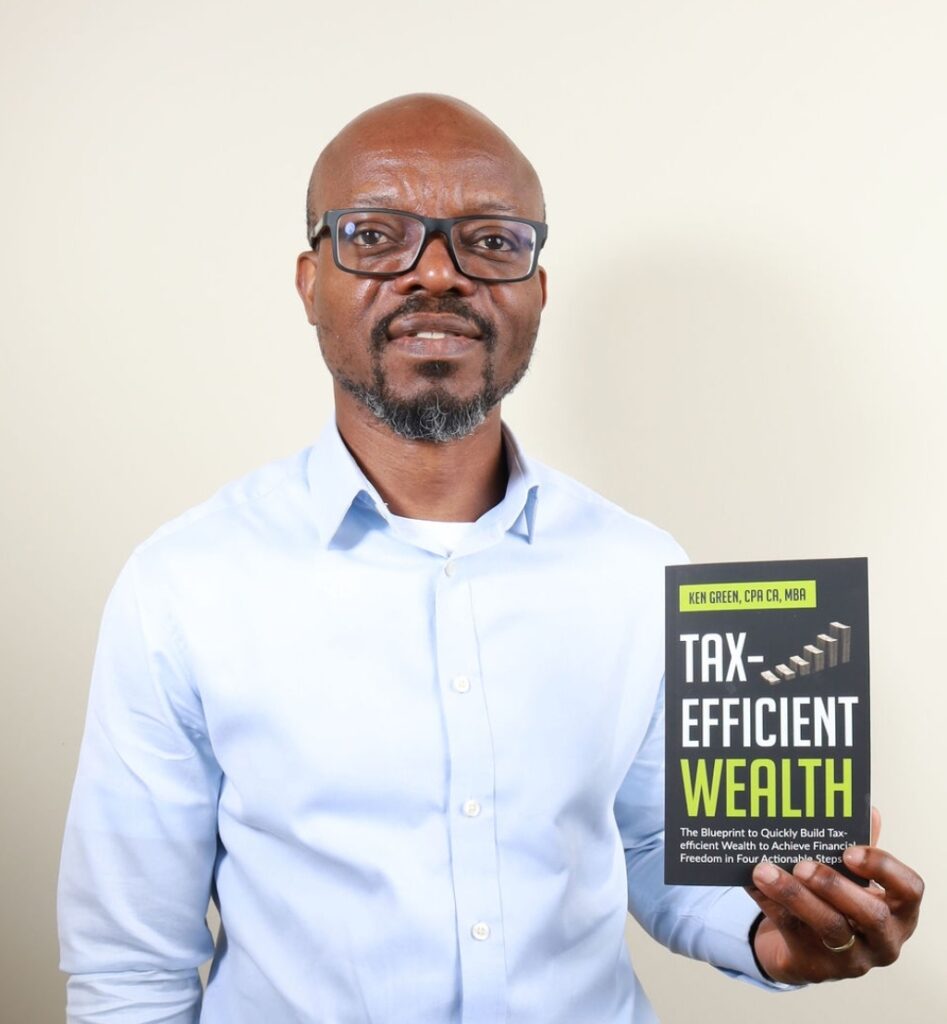

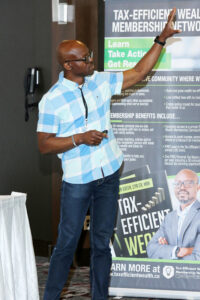

Ken Green (Host)

He’s the author of the book, Tax-Efficient Wealth and the creator of TaxEfficientWealth.ca, a platform designed to educate and coach individuals on how to achieve a breakthrough in their personal and business finance. Ken is on a mission to get every Canadian to take meaningful action to achieve financial freedom. He is a leading authority on taxes and personal finance and a regular contributor on Medium, where he shares his knowledge through a number of published articles. Ken works with professionals and business owners to manage their taxes. And he has helped hundreds of clients to create a path to financial freedom through his tax and business advisory services.

Aravind Sithamparapillai

Aravind is a Financial Advisor with Ironwood Wealth Management Group. He’s a passionate and experienced financial planner with specialty working with incorporated business owners, sales professionals, director-level employees and health professionals like mid-wives and doctors. His financial planning services are designed to address typical planning challenges like investment planning and tax efficiency of various investment vehicles, ideal structures for preserving the family wealth, compensation for business owners and stock option planning and execution.

Wesley Ogude

Wesley is a multi-faceted professional, holding three accounting designations—Chartered Accountant (ICAN), Chartered Professional Accountant (CPA, Canada), and Certified Management Accountant (CMA, USA). He also holds 2 MBAs, including an executive MBA from Queen’s University in Canada. Wesley is passionate about helping his clients across North America, Europe and Africa, to create and preserve multi-transgenerational wealth. As a seasoned wealth consultant, astute executive business mentor, Wesley invites you to explore lasting wealth transformation. Whether you are a high-net-worth professional, executive, or entrepreneur, Wesley brings a unique blend of expertise, passion, and strategic acumen to elevate your financial journey. Please visit https://highincometowealth.com/ to learn more.

Event Schedule

9:30 am – 10:00 am

Arrival, snacks and coffee, networking

10:00 am – 10:15 am

Welcome / Opening Remarks by Ken Green

10:15 am – 11:00 am

5 Key Planning Tips to save Tax Dollars and Keep More for your Retirement by Aravind Sithamparapillai

11:00 am – 11:15 am

Coffee Break / Networking

11:15 am – 12:00 am

Managing Cash Flow & Retirement Planning in times of Uncertainty by Ken Green

12:00 am – 1:00 pm

Lunch / Networking [FREE lunch provided with your registration]

1:00 pm – 1:45 pm

The Framework to Move from High Income to Wealth by Wesley Ogude

1:45 pm – 2:00 pm

Networking & Event Wrap

Incredible Bonuses For Early-Bird Fast Action Takers

Tax-Efficient Wealth eBook and Audio Book – For all Registered participants

Ideal for the busy professional on the go. The blueprint to quickly build tax-efficient wealth to achieve financial freedom in four actionable steps

[$27 Value]

Tax-Efficient Wealth Book (Hard copy) – If you already have a copy, consider giving this to someone else as a gift!

Keep for yourself or share with those you love. The blueprint to quickly build tax-efficient wealth to achieve financial freedom in four actionable steps

[$17 Value]

Complimentary 30-min Financial Coaching & Tax Planning Strategy Call with Ken Green – only for the first 10 people

No matter your current situation, get deep insights on this 30-minutes call with Ken on how to optimize your current situation and apply true and tested strategies to minimize taxes and get on a path to tax-efficient wealth.

[$250 Value]

Here’s Everything You Get When You Register Today (Before the EARLY BIRD Discount Expires)

-

• Access To The Tax Efficient Wealth Summit LIVE [$497 Value]

-

• Tax-Efficient Wealth eBook and Audio Book – For all Registered participants [$27 Value]

-

• Tax-Efficient Wealth Book (Hard copy) – If you already have a copy, consider giving this to someone else as a gift! [$17 Value]

-

• Complimentary 30-min Financial Coaching & Tax Planning Strategy Call with Ken Green – only for the first 10 people [$250 Value]